BLOGS

BUYERS

OTHER BLOGS

- Murrayville Neighbourhood Guide [Best Neighbourhoods in Langley BC]

![feature image of Murrayville Neighbourhood Guide [Best Neighbourhoods in Langley BC]](https://cdn.chime.me/image/fs/cmsbuild/2025220/20/w600_original_f24dd44f-cef2-4508-af2b-864ae570ce5a-png.webp) The Ultimate Guide to Living in Murrayville, Langley, BC Introduction Thinking about moving to Murrayville, Langley? Whether you're relocating or just want to learn more about this charming community, you're in the right place! This guide will cover everything you need to know about Murrayville, from its location, housing market, rental prices, schools, parks, amenities, and more. By the end of this article, you'll have a complete picture of what living in Murrayville is like and whether it's the right fit for you. Where is Murrayville Located? Murrayville is one of Langley's most historic and sought-after communities, located in the Township of Langley. It’s bordered by: Langley City (to the west) Brookswood (to the southwest) Campbell Valley (to the southeast) Salmon River (to the northeast) Driving Times to Major Destinations Murrayville provides easy access to major routes, making it a convenient location. Here’s how long it takes to drive to key places: Costco – 5-10 minutes Downtown Vancouver – 50 minutes Burnaby – 30 minutes Abbotsford – 35 minutes SkyTrain Station – 30 minutes Vancouver Airport (YVR) – 50 minutes U.S. Border – 25 minutes Tsawwassen Ferry Terminal – 50 minutes Murrayville Housing Market Murrayville features a mix of condos, townhomes, and detached homes, mostly built in the 1990s. Lot sizes here are larger than newer developments but still smaller than some of Langley’s more rural areas. There are fewer basement suites, but street parking is widely available. Murrayville Home Prices Here’s a look at benchmark home prices in Murrayville: Detached Homes – $1.702 million Townhomes – $972,000 Condos – $590,000 Compared to the rest of Langley: Detached homes and condos are more affordable Townhomes are slightly more expensive Rental Market Rental availability in Murrayville is limited due to older developments and rental restrictions in strata buildings. However, if you find a rental, expect slightly higher-than-average prices due to proximity to the hospital and low supply. 1-Bedroom Condo – $1,600 - $1,700/month 2-Bedroom Condo – $2,200 - $2,300/month 3-Bedroom Townhome – $2,800 - $3,000/month Highlights of Living in Murrayville 1. Community Charm Murrayville is one of Langley’s most historic and picturesque neighborhoods. With its older buildings, tree-lined streets, and heritage homes, many people compare it to Pleasantville for its clean, well-kept community feel. 2. Safety & Healthcare Access Murrayville is home to: Langley Memorial Hospital RCMP Detachment Various walk-in clinics and specialized healthcare services This makes it one of the safest and lowest-crime communities in Langley. 3. Slower Pace of Living Unlike the busy Willoughby or Langley City, Murrayville offers a quieter, more relaxed lifestyle, perfect for families, retirees, and professionals who prefer a peaceful neighborhood. Parks & Recreation in Murrayville Murrayville has several parks and recreational areas, including: Top Parks: Porter Park James Hill Park Murrayville Outdoor Activity Park & Skate Park McLeod Athletic Park – Featuring a track, football field, tennis courts, and soccer fields Golf Courses: Langley Golf & Banquet Centre (Par-3 course with a driving range) Newlands Golf & Country Club (Full 18-hole course) Schools in Murrayville Elementary Schools: James Hill Elementary Langley Fundamental Elementary Credo Christian Elementary High Schools: Langley Secondary School Daycares: There are several daycares in Murrayville, but spaces fill up fast. If you’re planning a move, apply for daycare spots early! Amenities & Shopping Murrayville offers basic amenities but no major retail stores. Thankfully, Langley City (5-10 minutes away) has everything you need. Key Amenities: WC Blair Recreation Centre – Features a wave pool, diving boards, climbing wall, and gym Langley Regional Airport & Canadian Museum of Flight Murrayville Library Grocery Stores: IGA Ralph’s Market Best Restaurants in Murrayville: Murrayville Town Pub – Great pub food and a friendly atmosphere Porter’s Bistro – Known for amazing coffee and live music nights Nikko Sushi – One of the best sushi spots in Langley Adrian’s at the Airport – A unique spot with great food and a view of the runway Ricky’s All Day Grill – A classic favorite Fast Food & Coffee Shops: A&W, Quiznos, McDonald’s The Joy of Coffee, Tracy Cakes Bakery Cafe, Balance Cafe Transportation & Walkability Walkability Score: 18 (Car-dependent) Bike Score: 76 (Very bikeable) Transit Score: 29 (Limited public transit) Murrayville has some bus routes along Fraser Highway, but owning a car is recommended. Ride-share services like Uber and Lyft are widely available. SkyTrain Extension Coming in 2029! A new SkyTrain extension is set to reach Langley City by 2029, making transit more convenient in the future. Who is Murrayville Best For? 1. Young Professionals Affordable condos & townhomes Peaceful yet connected community 2. Families Top-rated schools & safe environment Large homes & great parks 3. Retirees & Seniors Close proximity to Langley Memorial Hospital Age-restricted townhome communities available Things You Might Not Like About Murrayville Slightly farther from major highways (compared to other Langley neighborhoods) More sirens & aircraft noise due to the hospital and airport Limited shopping options (though Langley City is close by) Final Thoughts: Is Murrayville Right for You? Murrayville is a safe, family-friendly, and well-established community in Langley. With great amenities, schools, and healthcare, it’s a fantastic place to live, especially for families, professionals, and retirees. If you’re considering moving to Langley and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for Homes in Langley: Langley Homes for Sale 📕 Download our FREE Langley Relocation Guide: Ultimate Langley Relocation Guide

The Ultimate Guide to Living in Murrayville, Langley, BC Introduction Thinking about moving to Murrayville, Langley? Whether you're relocating or just want to learn more about this charming community, you're in the right place! This guide will cover everything you need to know about Murrayville, from its location, housing market, rental prices, schools, parks, amenities, and more. By the end of this article, you'll have a complete picture of what living in Murrayville is like and whether it's the right fit for you. Where is Murrayville Located? Murrayville is one of Langley's most historic and sought-after communities, located in the Township of Langley. It’s bordered by: Langley City (to the west) Brookswood (to the southwest) Campbell Valley (to the southeast) Salmon River (to the northeast) Driving Times to Major Destinations Murrayville provides easy access to major routes, making it a convenient location. Here’s how long it takes to drive to key places: Costco – 5-10 minutes Downtown Vancouver – 50 minutes Burnaby – 30 minutes Abbotsford – 35 minutes SkyTrain Station – 30 minutes Vancouver Airport (YVR) – 50 minutes U.S. Border – 25 minutes Tsawwassen Ferry Terminal – 50 minutes Murrayville Housing Market Murrayville features a mix of condos, townhomes, and detached homes, mostly built in the 1990s. Lot sizes here are larger than newer developments but still smaller than some of Langley’s more rural areas. There are fewer basement suites, but street parking is widely available. Murrayville Home Prices Here’s a look at benchmark home prices in Murrayville: Detached Homes – $1.702 million Townhomes – $972,000 Condos – $590,000 Compared to the rest of Langley: Detached homes and condos are more affordable Townhomes are slightly more expensive Rental Market Rental availability in Murrayville is limited due to older developments and rental restrictions in strata buildings. However, if you find a rental, expect slightly higher-than-average prices due to proximity to the hospital and low supply. 1-Bedroom Condo – $1,600 - $1,700/month 2-Bedroom Condo – $2,200 - $2,300/month 3-Bedroom Townhome – $2,800 - $3,000/month Highlights of Living in Murrayville 1. Community Charm Murrayville is one of Langley’s most historic and picturesque neighborhoods. With its older buildings, tree-lined streets, and heritage homes, many people compare it to Pleasantville for its clean, well-kept community feel. 2. Safety & Healthcare Access Murrayville is home to: Langley Memorial Hospital RCMP Detachment Various walk-in clinics and specialized healthcare services This makes it one of the safest and lowest-crime communities in Langley. 3. Slower Pace of Living Unlike the busy Willoughby or Langley City, Murrayville offers a quieter, more relaxed lifestyle, perfect for families, retirees, and professionals who prefer a peaceful neighborhood. Parks & Recreation in Murrayville Murrayville has several parks and recreational areas, including: Top Parks: Porter Park James Hill Park Murrayville Outdoor Activity Park & Skate Park McLeod Athletic Park – Featuring a track, football field, tennis courts, and soccer fields Golf Courses: Langley Golf & Banquet Centre (Par-3 course with a driving range) Newlands Golf & Country Club (Full 18-hole course) Schools in Murrayville Elementary Schools: James Hill Elementary Langley Fundamental Elementary Credo Christian Elementary High Schools: Langley Secondary School Daycares: There are several daycares in Murrayville, but spaces fill up fast. If you’re planning a move, apply for daycare spots early! Amenities & Shopping Murrayville offers basic amenities but no major retail stores. Thankfully, Langley City (5-10 minutes away) has everything you need. Key Amenities: WC Blair Recreation Centre – Features a wave pool, diving boards, climbing wall, and gym Langley Regional Airport & Canadian Museum of Flight Murrayville Library Grocery Stores: IGA Ralph’s Market Best Restaurants in Murrayville: Murrayville Town Pub – Great pub food and a friendly atmosphere Porter’s Bistro – Known for amazing coffee and live music nights Nikko Sushi – One of the best sushi spots in Langley Adrian’s at the Airport – A unique spot with great food and a view of the runway Ricky’s All Day Grill – A classic favorite Fast Food & Coffee Shops: A&W, Quiznos, McDonald’s The Joy of Coffee, Tracy Cakes Bakery Cafe, Balance Cafe Transportation & Walkability Walkability Score: 18 (Car-dependent) Bike Score: 76 (Very bikeable) Transit Score: 29 (Limited public transit) Murrayville has some bus routes along Fraser Highway, but owning a car is recommended. Ride-share services like Uber and Lyft are widely available. SkyTrain Extension Coming in 2029! A new SkyTrain extension is set to reach Langley City by 2029, making transit more convenient in the future. Who is Murrayville Best For? 1. Young Professionals Affordable condos & townhomes Peaceful yet connected community 2. Families Top-rated schools & safe environment Large homes & great parks 3. Retirees & Seniors Close proximity to Langley Memorial Hospital Age-restricted townhome communities available Things You Might Not Like About Murrayville Slightly farther from major highways (compared to other Langley neighborhoods) More sirens & aircraft noise due to the hospital and airport Limited shopping options (though Langley City is close by) Final Thoughts: Is Murrayville Right for You? Murrayville is a safe, family-friendly, and well-established community in Langley. With great amenities, schools, and healthcare, it’s a fantastic place to live, especially for families, professionals, and retirees. If you’re considering moving to Langley and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for Homes in Langley: Langley Homes for Sale 📕 Download our FREE Langley Relocation Guide: Ultimate Langley Relocation Guide

- Langley City: Everything to Need to Know About Living in the City of Langley

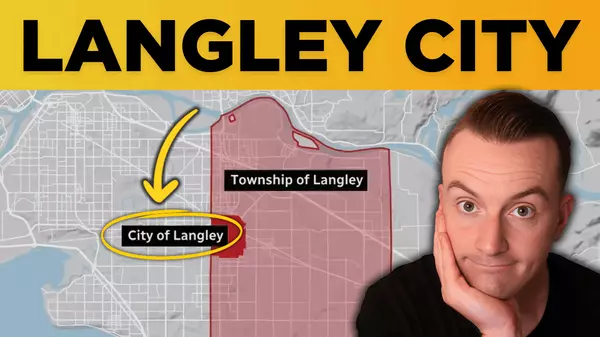

Everything You Need to Know Before Moving to Langley City, BC If you've been considering moving to Langley City, BC, or just want to learn more about this vibrant municipality, you're in the right place! In this guide, we'll cover everything from home prices and rental costs to shopping, amenities, schools, parks, and more. Whether you're looking for an affordable place to live, a great neighborhood for families, or a lively urban community, Langley City has something for everyone. General Overview of Langley City Langley City is a 10-square-kilometer urban center located in the middle of the Lower Mainland with a population of nearly 30,000 people. The city offers all the amenities of a major urban center, including: Diverse shopping and dining options World-class education and entertainment facilities Over 346 acres of parkland Excellent public transit and commuter routes Location & Accessibility Langley City is located directly east of Surrey and is bordered by: Cloverdale (West) Willoughby (North) Salmon River (Northeast) Murrayville (Southeast) Brookswood (South) It is a part of the Metro Vancouver Regional District and has quick access to major highways and three U.S. border crossings. Driving Times to Major Landmarks Downtown Vancouver: 45 minutes Burnaby: 30 minutes Abbotsford: 30 minutes SkyTrain (King George Station): 20-25 minutes Vancouver Airport: 45 minutes U.S. Border: 20 minutes Tsawwassen Ferries: 40 minutes Langley Hospital: 5-10 minutes Housing Market in Langley City Langley City offers a mix of condos, townhomes, and detached homes. Many homes were built between the 1960s and 1990s, and lot sizes tend to be smaller compared to the rest of Langley. Langley City Home Prices Detached Homes: $1.273M Townhomes: $814K Condos: $583K Langley City offers some of the lowest real estate prices in the region, making it a great option for first-time buyers and investors. Rental Prices in Langley City Langley City has a high percentage of rental-friendly properties, particularly condos and townhomes. Here’s what you can expect: 1-Bedroom Condo: $1,600/month 2-Bedroom Condo: $2,200/month 3-Bedroom Condo: $2,800/month 3-Bedroom Townhome: $3,200/month Rental prices in Langley City are lower than in the rest of Langley, making it a more affordable option for renters. Why Langley City? Top Highlights 1. Convenient & Walkable Langley City combines urban life with suburban charm, featuring walkable neighborhoods, shops, and excellent transit options. 2. Fantastic Shopping & Dining Langley City has a mix of big-box retailers and independent boutiques, with highlights including: Willowbrook Mall (expanding to 200+ stores!) Dozens of independent coffee shops & breweries Diverse restaurants (Thai, Sushi, Italian, Pizza, Vegan, etc.) 3. Entertainment & Nightlife There are plenty of things to do year-round, including: Cascades Casino & Coast Hotel (over 1,000 slot machines) Festivals, concerts, & parades Craft breweries & trendy bars 4. Green Spaces & Outdoor Activities Langley City is home to several parks and walking trails, including: Sendall Gardens Brydon Park & Lagoon Nicomekl Trail Douglas Park (community events & activities) 5. Schools & Daycares Langley City has nine schools, including: H.D. Stafford Middle School Nicomekl Elementary Uplands Elementary There are also numerous daycare options, but apply early due to high demand! Who is Langley City Best For? ✅ Young Professionals & Couples With affordable home prices, trendy cafes, and a growing craft beer scene, Langley City is perfect for young buyers looking for a vibrant, walkable community. ✅ Families Affordable detached homes, parks, and family-friendly neighborhoods make Langley City a great choice for growing families. ✅ Retirees & Seniors Langley City has numerous 45+ and 55+ communities, as well as easy access to medical services at Langley Memorial Hospital. Things You Might Not Like About Langley City 1. Higher Crime in Certain Areas While most of Langley City is safe, some areas have higher crime rates—primarily near the downtown core where support services are based. This is why it’s crucial to work with a local real estate expert who knows which areas to avoid. 2. Traffic on 200th Street Traffic can be a nightmare during rush hour, especially if a train passes through the area. 3. No SkyTrain (Yet) Public transit is good, but the SkyTrain extension won’t arrive until 2029. Final Thoughts: Is Langley City Right for You? Langley City offers affordability, walkability, and urban amenities while still maintaining a small-town feel. Whether you're a first-time homebuyer, a family, or a retiree, Langley City has something to offer. If you’re considering moving to Langley and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for Homes in Langley: Langley Homes for Sale 📕 Download our FREE Langley Relocation Guide: Ultimate Langley Relocation Guide

Everything You Need to Know Before Moving to Langley City, BC If you've been considering moving to Langley City, BC, or just want to learn more about this vibrant municipality, you're in the right place! In this guide, we'll cover everything from home prices and rental costs to shopping, amenities, schools, parks, and more. Whether you're looking for an affordable place to live, a great neighborhood for families, or a lively urban community, Langley City has something for everyone. General Overview of Langley City Langley City is a 10-square-kilometer urban center located in the middle of the Lower Mainland with a population of nearly 30,000 people. The city offers all the amenities of a major urban center, including: Diverse shopping and dining options World-class education and entertainment facilities Over 346 acres of parkland Excellent public transit and commuter routes Location & Accessibility Langley City is located directly east of Surrey and is bordered by: Cloverdale (West) Willoughby (North) Salmon River (Northeast) Murrayville (Southeast) Brookswood (South) It is a part of the Metro Vancouver Regional District and has quick access to major highways and three U.S. border crossings. Driving Times to Major Landmarks Downtown Vancouver: 45 minutes Burnaby: 30 minutes Abbotsford: 30 minutes SkyTrain (King George Station): 20-25 minutes Vancouver Airport: 45 minutes U.S. Border: 20 minutes Tsawwassen Ferries: 40 minutes Langley Hospital: 5-10 minutes Housing Market in Langley City Langley City offers a mix of condos, townhomes, and detached homes. Many homes were built between the 1960s and 1990s, and lot sizes tend to be smaller compared to the rest of Langley. Langley City Home Prices Detached Homes: $1.273M Townhomes: $814K Condos: $583K Langley City offers some of the lowest real estate prices in the region, making it a great option for first-time buyers and investors. Rental Prices in Langley City Langley City has a high percentage of rental-friendly properties, particularly condos and townhomes. Here’s what you can expect: 1-Bedroom Condo: $1,600/month 2-Bedroom Condo: $2,200/month 3-Bedroom Condo: $2,800/month 3-Bedroom Townhome: $3,200/month Rental prices in Langley City are lower than in the rest of Langley, making it a more affordable option for renters. Why Langley City? Top Highlights 1. Convenient & Walkable Langley City combines urban life with suburban charm, featuring walkable neighborhoods, shops, and excellent transit options. 2. Fantastic Shopping & Dining Langley City has a mix of big-box retailers and independent boutiques, with highlights including: Willowbrook Mall (expanding to 200+ stores!) Dozens of independent coffee shops & breweries Diverse restaurants (Thai, Sushi, Italian, Pizza, Vegan, etc.) 3. Entertainment & Nightlife There are plenty of things to do year-round, including: Cascades Casino & Coast Hotel (over 1,000 slot machines) Festivals, concerts, & parades Craft breweries & trendy bars 4. Green Spaces & Outdoor Activities Langley City is home to several parks and walking trails, including: Sendall Gardens Brydon Park & Lagoon Nicomekl Trail Douglas Park (community events & activities) 5. Schools & Daycares Langley City has nine schools, including: H.D. Stafford Middle School Nicomekl Elementary Uplands Elementary There are also numerous daycare options, but apply early due to high demand! Who is Langley City Best For? ✅ Young Professionals & Couples With affordable home prices, trendy cafes, and a growing craft beer scene, Langley City is perfect for young buyers looking for a vibrant, walkable community. ✅ Families Affordable detached homes, parks, and family-friendly neighborhoods make Langley City a great choice for growing families. ✅ Retirees & Seniors Langley City has numerous 45+ and 55+ communities, as well as easy access to medical services at Langley Memorial Hospital. Things You Might Not Like About Langley City 1. Higher Crime in Certain Areas While most of Langley City is safe, some areas have higher crime rates—primarily near the downtown core where support services are based. This is why it’s crucial to work with a local real estate expert who knows which areas to avoid. 2. Traffic on 200th Street Traffic can be a nightmare during rush hour, especially if a train passes through the area. 3. No SkyTrain (Yet) Public transit is good, but the SkyTrain extension won’t arrive until 2029. Final Thoughts: Is Langley City Right for You? Langley City offers affordability, walkability, and urban amenities while still maintaining a small-town feel. Whether you're a first-time homebuyer, a family, or a retiree, Langley City has something to offer. If you’re considering moving to Langley and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for Homes in Langley: Langley Homes for Sale 📕 Download our FREE Langley Relocation Guide: Ultimate Langley Relocation Guide

- The TRUTH About the Surrey Langley SkyTrain Extension

How the Surrey-Langley SkyTrain Extension Will Impact Real Estate The Surrey-Langley SkyTrain extension isn’t just another transit project—it’s a game-changer for real estate, urban development, and the future of these thriving communities. If you’re a homeowner, property investor, or someone living in the area, this expansion is likely to affect you in a big way. In this blog, we’ll cover:✔ How the SkyTrain extension will impact property values✔ New investment opportunities✔ Potential challenges to watch for Let’s dive in! What Is the Surrey-Langley SkyTrain Extension? The Surrey-Langley SkyTrain extension is a 16-kilometer expansion of the Expo Line, running along Fraser Highway from King George Station in Surrey to Langley City Center. 🚉 Planned New Stations:✔ Fleetwood✔ Clayton Heights✔ Cloverdale✔ Willoughby✔ Langley City Center What makes this project so exciting is that it’s the first major rapid transit expansion south of the Fraser River in 30 years! 🌟 Key Benefits:✔ Direct transit from Langley to Vancouver (no transfers needed)✔ Reduced commute times for thousands of residents✔ Boosted property values in station-adjacent areas How the SkyTrain Will Transform Surrey & Langley This project is about more than just better transportation—it’s about transformation. When new transit stations are introduced, cities evolve rapidly. A prime example is how Brentwood in Burnaby and Joyce-Collingwood in Vancouver transformed after SkyTrain access was introduced. 🏗 Expected Changes in Surrey & Langley:✔ Higher property values within 500m of a station✔ More condo and townhome developments✔ New commercial hubs with shops, restaurants & offices✔ A rise in young professionals & families moving in The Surrey-Langley SkyTrain will attract:✔ Homebuyers looking for better affordability than Vancouver✔ Investors looking to capitalize on the high-growth potential✔ Businesses seeking new prime locations Real Estate Boom: Where to Invest Before Prices Surge 📈 Historically, properties near SkyTrain stations see a 10-20% price increase compared to surrounding areas. If you own property near one of these eight stations, you could be sitting on a goldmine. 🔑 Top Areas to Watch:✔ Willowbrook – Already attracting developer interest for high-density, mixed-use projects✔ Langley City Center – Will be the final stop, making it a hotspot for condos, townhomes & commercial spaces✔ Fleetwood & Clayton Heights – Prime areas for future urban hubs with retail, restaurants & green spaces 🏠 Investment Opportunities:✔ Pre-sale condos near new stations✔ Buying single-family homes for future redevelopment✔ Land assemblies for high-density developments For homeowners, even holding onto your property could lead to significant appreciation over time. Transit-Oriented Development: A New Way of Living "Transit-Oriented Development (TOD)" is a big buzzword in urban planning. TOD focuses on creating walkable, vibrant communities around transit hubs, including:✔ Mixed-use buildings (residential + commercial)✔ Shops, restaurants, and offices within walking distance✔ Parks, bike lanes, and pedestrian-friendly streets Areas like Fleetwood and Clayton Heights will likely be prime candidates for TOD, meaning:✔ More condo and townhome developments✔ Fewer single-family homes✔ A shift to urban-style living with shops & amenities just steps away If you’re looking for a lifestyle with convenience, transit access, and vibrant amenities, this expansion is going to redefine living in Surrey & Langley. Challenges & Concerns: What You Should Know Of course, with any major project, challenges arise. 🚧 Potential Issues:✔ Gentrification & rising costs – Property values may push out long-time renters & homeowners✔ Increased density & changing community feel – Higher density can alter the character of suburban neighborhoods✔ Construction disruptions – Noise, traffic delays, and road closures are likely in the short term 🏡 How Cities Can Manage These Issues:✔ Implement rent controls & affordable housing incentives✔ Ensure balanced zoning to preserve neighborhood character✔ Plan smart infrastructure to minimize congestion & maintain livability Despite these challenges, the long-term benefits are clear—more accessibility, better development, and increased property values. What’s Next for Surrey & Langley? This $4 billion SkyTrain expansion will position Surrey & Langley as high-demand urban centers, attracting:✔ New residents looking for affordability & accessibility✔ Real estate investors seeking appreciation potential✔ Businesses looking for expansion opportunities 📢 Key Takeaways:✔ If you own property near a future station, expect rising demand & prices✔ Investors should look into pre-sale condos & land near stations✔ Surrey & Langley are set to become Metro Vancouver’s next urban hubs 🚀 This is the time to start planning for the future! Thinking About Buying or Selling in Surrey or Langley? Let’s Talk! If you’re considering moving to Surrey and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Search for Homes: Homes for Sale 📕 FREE Surrey Relocation Guide: Ultimate Surrey Relocation Guide 📕 FREE Langley Relocation Guide: Ultimate Langley Relocation Guide

How the Surrey-Langley SkyTrain Extension Will Impact Real Estate The Surrey-Langley SkyTrain extension isn’t just another transit project—it’s a game-changer for real estate, urban development, and the future of these thriving communities. If you’re a homeowner, property investor, or someone living in the area, this expansion is likely to affect you in a big way. In this blog, we’ll cover:✔ How the SkyTrain extension will impact property values✔ New investment opportunities✔ Potential challenges to watch for Let’s dive in! What Is the Surrey-Langley SkyTrain Extension? The Surrey-Langley SkyTrain extension is a 16-kilometer expansion of the Expo Line, running along Fraser Highway from King George Station in Surrey to Langley City Center. 🚉 Planned New Stations:✔ Fleetwood✔ Clayton Heights✔ Cloverdale✔ Willoughby✔ Langley City Center What makes this project so exciting is that it’s the first major rapid transit expansion south of the Fraser River in 30 years! 🌟 Key Benefits:✔ Direct transit from Langley to Vancouver (no transfers needed)✔ Reduced commute times for thousands of residents✔ Boosted property values in station-adjacent areas How the SkyTrain Will Transform Surrey & Langley This project is about more than just better transportation—it’s about transformation. When new transit stations are introduced, cities evolve rapidly. A prime example is how Brentwood in Burnaby and Joyce-Collingwood in Vancouver transformed after SkyTrain access was introduced. 🏗 Expected Changes in Surrey & Langley:✔ Higher property values within 500m of a station✔ More condo and townhome developments✔ New commercial hubs with shops, restaurants & offices✔ A rise in young professionals & families moving in The Surrey-Langley SkyTrain will attract:✔ Homebuyers looking for better affordability than Vancouver✔ Investors looking to capitalize on the high-growth potential✔ Businesses seeking new prime locations Real Estate Boom: Where to Invest Before Prices Surge 📈 Historically, properties near SkyTrain stations see a 10-20% price increase compared to surrounding areas. If you own property near one of these eight stations, you could be sitting on a goldmine. 🔑 Top Areas to Watch:✔ Willowbrook – Already attracting developer interest for high-density, mixed-use projects✔ Langley City Center – Will be the final stop, making it a hotspot for condos, townhomes & commercial spaces✔ Fleetwood & Clayton Heights – Prime areas for future urban hubs with retail, restaurants & green spaces 🏠 Investment Opportunities:✔ Pre-sale condos near new stations✔ Buying single-family homes for future redevelopment✔ Land assemblies for high-density developments For homeowners, even holding onto your property could lead to significant appreciation over time. Transit-Oriented Development: A New Way of Living "Transit-Oriented Development (TOD)" is a big buzzword in urban planning. TOD focuses on creating walkable, vibrant communities around transit hubs, including:✔ Mixed-use buildings (residential + commercial)✔ Shops, restaurants, and offices within walking distance✔ Parks, bike lanes, and pedestrian-friendly streets Areas like Fleetwood and Clayton Heights will likely be prime candidates for TOD, meaning:✔ More condo and townhome developments✔ Fewer single-family homes✔ A shift to urban-style living with shops & amenities just steps away If you’re looking for a lifestyle with convenience, transit access, and vibrant amenities, this expansion is going to redefine living in Surrey & Langley. Challenges & Concerns: What You Should Know Of course, with any major project, challenges arise. 🚧 Potential Issues:✔ Gentrification & rising costs – Property values may push out long-time renters & homeowners✔ Increased density & changing community feel – Higher density can alter the character of suburban neighborhoods✔ Construction disruptions – Noise, traffic delays, and road closures are likely in the short term 🏡 How Cities Can Manage These Issues:✔ Implement rent controls & affordable housing incentives✔ Ensure balanced zoning to preserve neighborhood character✔ Plan smart infrastructure to minimize congestion & maintain livability Despite these challenges, the long-term benefits are clear—more accessibility, better development, and increased property values. What’s Next for Surrey & Langley? This $4 billion SkyTrain expansion will position Surrey & Langley as high-demand urban centers, attracting:✔ New residents looking for affordability & accessibility✔ Real estate investors seeking appreciation potential✔ Businesses looking for expansion opportunities 📢 Key Takeaways:✔ If you own property near a future station, expect rising demand & prices✔ Investors should look into pre-sale condos & land near stations✔ Surrey & Langley are set to become Metro Vancouver’s next urban hubs 🚀 This is the time to start planning for the future! Thinking About Buying or Selling in Surrey or Langley? Let’s Talk! If you’re considering moving to Surrey and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Search for Homes: Homes for Sale 📕 FREE Surrey Relocation Guide: Ultimate Surrey Relocation Guide 📕 FREE Langley Relocation Guide: Ultimate Langley Relocation Guide

- Top 5 Reasons to Move to Surrey BC

Top 5 Reasons to Live in Surrey, BC Surrey, BC, is one of the fastest-growing municipalities in British Columbia, attracting over 1,000 new residents each month. But what makes Surrey such a desirable place to live? In this guide, we’ll explore the top five reasons why people are choosing to move to Surrey and why it might be the perfect place for you. 1. Central Location & Accessibility Located just 23 km from downtown Vancouver, Surrey offers the perfect balance between big-city amenities and a quieter suburban lifestyle. It’s well-connected to the Lower Mainland through major highways and public transit options, making commuting a breeze. Key Transportation Links: Highway 99 – Connects to the Alex Fraser Bridge for South Surrey residents. Highway 1 – Leads to the Port Mann Bridge for those in Central and North Surrey. Fraser Highway – Provides access to the Pattullo Bridge into New Westminster. SkyTrain Expansion – Future extension connecting Fleetwood to Langley, improving accessibility for residents. With its central location and excellent transit options, Surrey is one of the best-connected cities in the Lower Mainland. 2. More Affordable Housing Options Vancouver’s real estate market is one of the most expensive in the world, driving homebuyers and renters to seek more affordable alternatives. Surrey offers a significant cost advantage while still being close to Vancouver. Home Price Comparisons: Property Type Vancouver Surrey Price Difference Detached Home $2.592M $1.783M ~30% lower Townhome $1.348M $904K ~33% lower Condo $813K $559K ~31% lower Rental Price Comparisons: Property Type Vancouver Surrey Price Difference 1-Bedroom $2,400+ $1,600+ ~33% lower 2-Bedroom $3,500+ $2,200+ ~37% lower 3-Bedroom $4,700+ $2,900+ ~38% lower For homebuyers and renters alike, Surrey offers better affordability while maintaining proximity to Vancouver. 3. Excellent Community Resources & Amenities Surrey is home to six major communities, each offering diverse services, shopping, healthcare, and recreational facilities. With ongoing investments in infrastructure and amenities, Surrey is an ideal place for families, professionals, and retirees. Key Community Highlights: Shopping Centers – Guildford Town Centre, Central City Mall Healthcare – Surrey Memorial Hospital, Jim Pattison Outpatient Care Recreation – Newton Wave Pool, Surrey Sport & Leisure, Grandview Heights Rec Centre Future Development – The upcoming Cloverdale Hospital & infrastructure projects With a blend of urban conveniences and suburban charm, Surrey provides everything you need in one place. 4. Outdoor Activities & Green Spaces Often referred to as the City of Parks, Surrey boasts over 600 parks and 277 trails and walkways. Whether you enjoy hiking, biking, golfing, or beach outings, Surrey has it all. Top Outdoor Attractions: Parks – Tynehead Park, Bear Creek Park, Fleetwood Park Beaches – Crescent Beach, Centennial Beach, White Rock Beach Golf Courses – Morgan Creek Golf Course, Northview Golf & Country Club Dog Parks – Off-leash parks across Surrey’s communities With an abundance of green spaces and recreation, Surrey is a paradise for nature lovers and outdoor enthusiasts. 5. Mild & Comfortable Climate Surrey enjoys a mild Pacific Northwest climate, making it an attractive option for those looking to avoid extreme weather conditions found in other parts of Canada. Surrey Weather Overview: Spring (March-May) – Mild temperatures, occasional rain Summer (June-August) – Warm, sunny days (~22°C on average, highs over 30°C) Fall (September-November) – Crisp air, vibrant foliage Winter (December-February) – Rare snow, mild temperatures (~4-5°C) Despite occasional rain, Surrey’s climate is one of the most moderate in Canada, making it ideal for year-round outdoor activities. Bonus: Diverse & Friendly Community Surrey is one of Canada’s most diverse cities, with a welcoming atmosphere for newcomers. The city’s large South Asian, Chinese, and Filipino populations contribute to a rich cultural landscape, including festivals, restaurants, and community events. Major Annual Events: Surrey Canada Day – One of the biggest celebrations in BC Surrey Fusion Festival – Showcasing multicultural food and entertainment Cloverdale Rodeo – Canada’s second-largest rodeo Vaisakhi Parade – The largest outside of India, drawing over 500,000 participants With its multicultural vibrancy and strong community spirit, Surrey is an inclusive city where everyone can feel at home. Final Thoughts & Next Steps Surrey offers affordable housing, excellent amenities, great accessibility, and a mild climate, making it a top destination for homebuyers and renters. If you’re considering moving to Surrey, I’d love to help you find the perfect home! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for Homes in Surrey: Surrey Homes for Sale 📕 Download our FREE Surrey Relocation Guide: Ultimate Surrey Relocation Guide

Top 5 Reasons to Live in Surrey, BC Surrey, BC, is one of the fastest-growing municipalities in British Columbia, attracting over 1,000 new residents each month. But what makes Surrey such a desirable place to live? In this guide, we’ll explore the top five reasons why people are choosing to move to Surrey and why it might be the perfect place for you. 1. Central Location & Accessibility Located just 23 km from downtown Vancouver, Surrey offers the perfect balance between big-city amenities and a quieter suburban lifestyle. It’s well-connected to the Lower Mainland through major highways and public transit options, making commuting a breeze. Key Transportation Links: Highway 99 – Connects to the Alex Fraser Bridge for South Surrey residents. Highway 1 – Leads to the Port Mann Bridge for those in Central and North Surrey. Fraser Highway – Provides access to the Pattullo Bridge into New Westminster. SkyTrain Expansion – Future extension connecting Fleetwood to Langley, improving accessibility for residents. With its central location and excellent transit options, Surrey is one of the best-connected cities in the Lower Mainland. 2. More Affordable Housing Options Vancouver’s real estate market is one of the most expensive in the world, driving homebuyers and renters to seek more affordable alternatives. Surrey offers a significant cost advantage while still being close to Vancouver. Home Price Comparisons: Property Type Vancouver Surrey Price Difference Detached Home $2.592M $1.783M ~30% lower Townhome $1.348M $904K ~33% lower Condo $813K $559K ~31% lower Rental Price Comparisons: Property Type Vancouver Surrey Price Difference 1-Bedroom $2,400+ $1,600+ ~33% lower 2-Bedroom $3,500+ $2,200+ ~37% lower 3-Bedroom $4,700+ $2,900+ ~38% lower For homebuyers and renters alike, Surrey offers better affordability while maintaining proximity to Vancouver. 3. Excellent Community Resources & Amenities Surrey is home to six major communities, each offering diverse services, shopping, healthcare, and recreational facilities. With ongoing investments in infrastructure and amenities, Surrey is an ideal place for families, professionals, and retirees. Key Community Highlights: Shopping Centers – Guildford Town Centre, Central City Mall Healthcare – Surrey Memorial Hospital, Jim Pattison Outpatient Care Recreation – Newton Wave Pool, Surrey Sport & Leisure, Grandview Heights Rec Centre Future Development – The upcoming Cloverdale Hospital & infrastructure projects With a blend of urban conveniences and suburban charm, Surrey provides everything you need in one place. 4. Outdoor Activities & Green Spaces Often referred to as the City of Parks, Surrey boasts over 600 parks and 277 trails and walkways. Whether you enjoy hiking, biking, golfing, or beach outings, Surrey has it all. Top Outdoor Attractions: Parks – Tynehead Park, Bear Creek Park, Fleetwood Park Beaches – Crescent Beach, Centennial Beach, White Rock Beach Golf Courses – Morgan Creek Golf Course, Northview Golf & Country Club Dog Parks – Off-leash parks across Surrey’s communities With an abundance of green spaces and recreation, Surrey is a paradise for nature lovers and outdoor enthusiasts. 5. Mild & Comfortable Climate Surrey enjoys a mild Pacific Northwest climate, making it an attractive option for those looking to avoid extreme weather conditions found in other parts of Canada. Surrey Weather Overview: Spring (March-May) – Mild temperatures, occasional rain Summer (June-August) – Warm, sunny days (~22°C on average, highs over 30°C) Fall (September-November) – Crisp air, vibrant foliage Winter (December-February) – Rare snow, mild temperatures (~4-5°C) Despite occasional rain, Surrey’s climate is one of the most moderate in Canada, making it ideal for year-round outdoor activities. Bonus: Diverse & Friendly Community Surrey is one of Canada’s most diverse cities, with a welcoming atmosphere for newcomers. The city’s large South Asian, Chinese, and Filipino populations contribute to a rich cultural landscape, including festivals, restaurants, and community events. Major Annual Events: Surrey Canada Day – One of the biggest celebrations in BC Surrey Fusion Festival – Showcasing multicultural food and entertainment Cloverdale Rodeo – Canada’s second-largest rodeo Vaisakhi Parade – The largest outside of India, drawing over 500,000 participants With its multicultural vibrancy and strong community spirit, Surrey is an inclusive city where everyone can feel at home. Final Thoughts & Next Steps Surrey offers affordable housing, excellent amenities, great accessibility, and a mild climate, making it a top destination for homebuyers and renters. If you’re considering moving to Surrey, I’d love to help you find the perfect home! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for Homes in Surrey: Surrey Homes for Sale 📕 Download our FREE Surrey Relocation Guide: Ultimate Surrey Relocation Guide

- Pros & Cons of Living in Maple Ridge BC

Pros & Cons of Living in Maple Ridge BC | Life in Maple Ridge BC Maple Ridge is a beautiful city with many desirable features, but like any place, it has its downsides. If you're considering a move, it’s essential to get an honest and unbiased overview of what this city has to offer. In this blog post, we’ll dive into the pros and cons of living in Maple Ridge so you can make an informed decision. Pros of Living in Maple Ridge 1. Beautiful Outdoor Opportunities Maple Ridge is nestled between the Fraser River and the stunning Coast Mountains, providing residents with breathtaking natural beauty and outdoor recreational opportunities. Golden Ears Provincial Park: Over 154,000 acres of wilderness with hiking, camping, and scenic views. Kanaka Creek Regional Park: Great for walking trails, a fish hatchery, and wildlife observation. Fraser River: Offers excellent fishing and kayaking opportunities. Golf Courses: Nearby courses in Pitt Meadows include Meadow Gardens, Swan-e-Set, and Golden Eagle. Parks and Playgrounds: A variety of green spaces across the city ensure that families have plenty of options for recreation. If you love the outdoors, Maple Ridge provides endless activities for hiking, biking, and enjoying nature. 2. Family-Friendly Community Maple Ridge is known for its strong community spirit and family-oriented environment. Great Schools: Includes top-rated schools like Garibaldi Secondary (IB program) and Meadowridge School (K-12 independent school). Community Events: Festivals like the Caribbean Festival and Country Fest bring people together. Family Parks: Memorial Peace Park and Albion Fairgrounds host events and provide play areas for kids. Leisure Center: Offers swimming pools, fitness programs, and community activities for all ages. The tight-knit community makes it a great place to raise a family with plenty of opportunities to get involved and make lifelong connections. 3. Affordable Housing (Compared to Vancouver) While Greater Vancouver is known for its sky-high housing prices, Maple Ridge remains one of the more affordable options in the region. Detached Homes: About 40-50% cheaper than Vancouver. Townhomes & Condos: Roughly 10-20% cheaper than Langley or Surrey. New Developments: Areas like Albion and Silver Valley are expanding, offering more modern housing options. While prices aren’t “cheap,” Maple Ridge still allows first-time buyers and families to own homes without breaking the bank. 4. Proximity to Urban Centers Maple Ridge offers a perfect blend of suburban charm and city convenience. Lougheed Highway (Hwy 7): Direct access to Vancouver and neighboring cities. Golden Ears Bridge: Connects to Langley and Surrey for easier commuting. West Coast Express: A stress-free commuter train to downtown Vancouver. Shopping & Dining: Haney Place Mall and Valley Fair Mall offer a variety of retail and dining options. For those working in Metro Vancouver, Maple Ridge provides a quieter home environment while remaining well-connected to urban areas. Cons of Living in Maple Ridge 1. Traffic & Commuting Challenges While Maple Ridge is close to Vancouver, commuting can be time-consuming. Heavy Traffic: Lougheed Highway and Golden Ears Bridge can get congested during peak hours. West Coast Express Limitations: Trains run only during weekday rush hours (every 30 minutes). Public Transit: Limited bus service means most residents need a car to get around. If you rely on public transportation, Maple Ridge may not be the most convenient place to live. 2. Homelessness & Crime Issues Unfortunately, homelessness and crime have been growing concerns in Maple Ridge, particularly in certain areas like Haney and Town Centre. Homeless Encampments: Persistent despite city efforts to build more housing projects. Property Crime: Break-ins and thefts are more common in some parts of the city. Drug Activity: More visible near downtown and transit hubs. Local law enforcement has increased patrols and community programs to address these issues, but they remain a factor for potential residents to consider. 3. Weather: Rainy & Damp Winters Maple Ridge experiences typical Pacific Northwest weather: Heavy Rain (Oct–Mar): Prolonged rainy season can feel dreary. More Snow than Vancouver: While mild, it gets more snowfall than the city. Short Summers: Warm but brief, making outdoor activities seasonal. For those used to sunnier, drier climates, adjusting to the wet weather might take time. 4. Limited Nightlife & Entertainment Compared to larger cities like Vancouver, Maple Ridge lacks nightlife and entertainment options. Few Nightclubs & Bars: Only a handful of local pubs and breweries. Entertainment Venues: The ACT Arts Centre hosts performances, but options are limited. For More Fun: Most nightlife options require a drive to Vancouver or Burnaby. If you’re looking for a vibrant nightlife scene, you’ll need to travel outside of Maple Ridge. 5. Rapid Growth & Construction While new developments bring better amenities and housing, they also create: More Traffic: Construction zones slow down commutes. Higher Density: Some residents worry about losing the city’s rural charm. Increased Demand: More people moving in could drive up housing prices. While growth is necessary, some long-time residents feel Maple Ridge is losing its small-town feel due to rapid urbanization. Is Maple Ridge Right for You? Maple Ridge is an amazing place to live with beautiful scenery, affordable housing, and a strong sense of community. However, it’s important to weigh the commuting challenges, crime concerns, and rainy weather before making a decision. If you’re considering moving to Maple Ridge and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for homes in Maple Ridge: Maple Ridge Homes for Sale

Pros & Cons of Living in Maple Ridge BC | Life in Maple Ridge BC Maple Ridge is a beautiful city with many desirable features, but like any place, it has its downsides. If you're considering a move, it’s essential to get an honest and unbiased overview of what this city has to offer. In this blog post, we’ll dive into the pros and cons of living in Maple Ridge so you can make an informed decision. Pros of Living in Maple Ridge 1. Beautiful Outdoor Opportunities Maple Ridge is nestled between the Fraser River and the stunning Coast Mountains, providing residents with breathtaking natural beauty and outdoor recreational opportunities. Golden Ears Provincial Park: Over 154,000 acres of wilderness with hiking, camping, and scenic views. Kanaka Creek Regional Park: Great for walking trails, a fish hatchery, and wildlife observation. Fraser River: Offers excellent fishing and kayaking opportunities. Golf Courses: Nearby courses in Pitt Meadows include Meadow Gardens, Swan-e-Set, and Golden Eagle. Parks and Playgrounds: A variety of green spaces across the city ensure that families have plenty of options for recreation. If you love the outdoors, Maple Ridge provides endless activities for hiking, biking, and enjoying nature. 2. Family-Friendly Community Maple Ridge is known for its strong community spirit and family-oriented environment. Great Schools: Includes top-rated schools like Garibaldi Secondary (IB program) and Meadowridge School (K-12 independent school). Community Events: Festivals like the Caribbean Festival and Country Fest bring people together. Family Parks: Memorial Peace Park and Albion Fairgrounds host events and provide play areas for kids. Leisure Center: Offers swimming pools, fitness programs, and community activities for all ages. The tight-knit community makes it a great place to raise a family with plenty of opportunities to get involved and make lifelong connections. 3. Affordable Housing (Compared to Vancouver) While Greater Vancouver is known for its sky-high housing prices, Maple Ridge remains one of the more affordable options in the region. Detached Homes: About 40-50% cheaper than Vancouver. Townhomes & Condos: Roughly 10-20% cheaper than Langley or Surrey. New Developments: Areas like Albion and Silver Valley are expanding, offering more modern housing options. While prices aren’t “cheap,” Maple Ridge still allows first-time buyers and families to own homes without breaking the bank. 4. Proximity to Urban Centers Maple Ridge offers a perfect blend of suburban charm and city convenience. Lougheed Highway (Hwy 7): Direct access to Vancouver and neighboring cities. Golden Ears Bridge: Connects to Langley and Surrey for easier commuting. West Coast Express: A stress-free commuter train to downtown Vancouver. Shopping & Dining: Haney Place Mall and Valley Fair Mall offer a variety of retail and dining options. For those working in Metro Vancouver, Maple Ridge provides a quieter home environment while remaining well-connected to urban areas. Cons of Living in Maple Ridge 1. Traffic & Commuting Challenges While Maple Ridge is close to Vancouver, commuting can be time-consuming. Heavy Traffic: Lougheed Highway and Golden Ears Bridge can get congested during peak hours. West Coast Express Limitations: Trains run only during weekday rush hours (every 30 minutes). Public Transit: Limited bus service means most residents need a car to get around. If you rely on public transportation, Maple Ridge may not be the most convenient place to live. 2. Homelessness & Crime Issues Unfortunately, homelessness and crime have been growing concerns in Maple Ridge, particularly in certain areas like Haney and Town Centre. Homeless Encampments: Persistent despite city efforts to build more housing projects. Property Crime: Break-ins and thefts are more common in some parts of the city. Drug Activity: More visible near downtown and transit hubs. Local law enforcement has increased patrols and community programs to address these issues, but they remain a factor for potential residents to consider. 3. Weather: Rainy & Damp Winters Maple Ridge experiences typical Pacific Northwest weather: Heavy Rain (Oct–Mar): Prolonged rainy season can feel dreary. More Snow than Vancouver: While mild, it gets more snowfall than the city. Short Summers: Warm but brief, making outdoor activities seasonal. For those used to sunnier, drier climates, adjusting to the wet weather might take time. 4. Limited Nightlife & Entertainment Compared to larger cities like Vancouver, Maple Ridge lacks nightlife and entertainment options. Few Nightclubs & Bars: Only a handful of local pubs and breweries. Entertainment Venues: The ACT Arts Centre hosts performances, but options are limited. For More Fun: Most nightlife options require a drive to Vancouver or Burnaby. If you’re looking for a vibrant nightlife scene, you’ll need to travel outside of Maple Ridge. 5. Rapid Growth & Construction While new developments bring better amenities and housing, they also create: More Traffic: Construction zones slow down commutes. Higher Density: Some residents worry about losing the city’s rural charm. Increased Demand: More people moving in could drive up housing prices. While growth is necessary, some long-time residents feel Maple Ridge is losing its small-town feel due to rapid urbanization. Is Maple Ridge Right for You? Maple Ridge is an amazing place to live with beautiful scenery, affordable housing, and a strong sense of community. However, it’s important to weigh the commuting challenges, crime concerns, and rainy weather before making a decision. If you’re considering moving to Maple Ridge and want to explore which neighbourhoods would suit you best, I’d be happy to help! 📞 Book a Call with Me: Schedule a Consultation 📢 Subscribe to my YouTube Channel: Living in the Lower Mainland 🏡 Looking for homes in Maple Ridge: Maple Ridge Homes for Sale