BLOGS

LIVING IN LANGLEY BC

MORE BLOGS ABOUT LIVING IN LANGLEY BC

View More

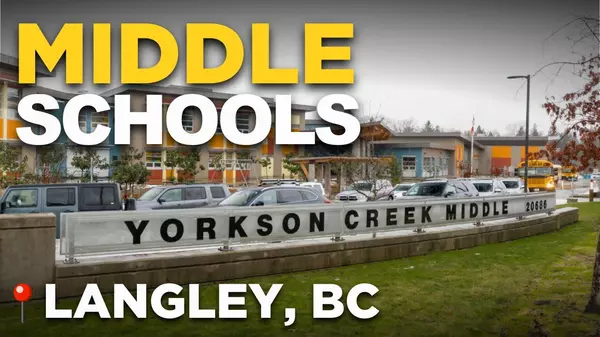

Top 5 Middle Schools in Langley BC Canada Revealed!Top 5 Public Middle Schools in Langley, BC 🎒✨ Choosing the right middle school for your child is one of the most important decisions you’ll make as a parent. These are the years where kids develop independence, explore new interests, and build the foundation for future academic success. If you’re r

Top 5 Middle Schools in Langley BC Canada Revealed!Top 5 Public Middle Schools in Langley, BC 🎒✨ Choosing the right middle school for your child is one of the most important decisions you’ll make as a parent. These are the years where kids develop independence, explore new interests, and build the foundation for future academic success. If you’re r Langley BC Canada - What It’s Really Like to Live HereWhy Langley BC is on Everyone’s Radar 🌿 Langley BC is no longer the sleepy suburb it once was. Over the last decade, the community has transformed into one of the most desirable relocation destinations in the Fraser Valley. With a mix of rural charm, suburban convenience, and rapid urban growth, La

Langley BC Canada - What It’s Really Like to Live HereWhy Langley BC is on Everyone’s Radar 🌿 Langley BC is no longer the sleepy suburb it once was. Over the last decade, the community has transformed into one of the most desirable relocation destinations in the Fraser Valley. With a mix of rural charm, suburban convenience, and rapid urban growth, La How Much Does It Really Cost to Live in Langley? (2025)Cost of Living in Langley BC (2025 Guide) 🏡✨ Thinking about moving to Langley, British Columbia? You’re not alone. Langley is one of the fastest-growing communities in Metro Vancouver, known for its suburban charm, family-friendly neighbourhoods, and expanding commercial hubs. But here’s the big qu

How Much Does It Really Cost to Live in Langley? (2025)Cost of Living in Langley BC (2025 Guide) 🏡✨ Thinking about moving to Langley, British Columbia? You’re not alone. Langley is one of the fastest-growing communities in Metro Vancouver, known for its suburban charm, family-friendly neighbourhoods, and expanding commercial hubs. But here’s the big qu Living in Langley BC (The REAL Reason People Love Living Here)🌟 Why Living in Langley BC Might Be the Best Move for Your Family Thinking about moving to Langley BC? You’re not alone. Over the past decade, Langley has become one of the most sought-after communities in Metro Vancouver, offering a unique balance of small-town charm and big-city amenities. If you

Living in Langley BC (The REAL Reason People Love Living Here)🌟 Why Living in Langley BC Might Be the Best Move for Your Family Thinking about moving to Langley BC? You’re not alone. Over the past decade, Langley has become one of the most sought-after communities in Metro Vancouver, offering a unique balance of small-town charm and big-city amenities. If you Top 5 Secondary Schools in Langley BC🏫 Top 5 Public High Schools in Langley, BC: Which One Is Right for Your Family? Choosing the right high school is one of the most important decisions for both students and parents. In a place like Langley, BC, where educational opportunities are diverse and high quality, this choice can set the ton

Top 5 Secondary Schools in Langley BC🏫 Top 5 Public High Schools in Langley, BC: Which One Is Right for Your Family? Choosing the right high school is one of the most important decisions for both students and parents. In a place like Langley, BC, where educational opportunities are diverse and high quality, this choice can set the ton Top 5 Middle Schools in Langley BC Canada🏫 Top 5 Public Middle Schools in Langley, BC: What Parents Need to Know Choosing the right middle school is one of the most important decisions for families—especially if you have children entering these formative years. Middle school is when students start to explore their interests, gain independ

Top 5 Middle Schools in Langley BC Canada🏫 Top 5 Public Middle Schools in Langley, BC: What Parents Need to Know Choosing the right middle school is one of the most important decisions for families—especially if you have children entering these formative years. Middle school is when students start to explore their interests, gain independ Exploring Langley BC Canada - What It’s Really Like to Live Here🌆 Langley, BC Is Rapidly Transforming – Here’s What You Need to Know Langley is no longer the quiet suburb it once was. 🚧 Rapid growth, new developments, and a surge in new residents are reshaping the area's character, infrastructure, and lifestyle. If you're considering a move or simply curious a

Exploring Langley BC Canada - What It’s Really Like to Live Here🌆 Langley, BC Is Rapidly Transforming – Here’s What You Need to Know Langley is no longer the quiet suburb it once was. 🚧 Rapid growth, new developments, and a surge in new residents are reshaping the area's character, infrastructure, and lifestyle. If you're considering a move or simply curious a REAL Pros & Cons of Langley BC Canada🌲 Is Living in Langley, BC Right for You? What You Need to Know Before Moving Langley, BC has become one of the most talked-about places to live in the Metro Vancouver area. With its blend of affordability, community charm, and access to outdoor spaces, it's no wonder that more people are making th

REAL Pros & Cons of Langley BC Canada🌲 Is Living in Langley, BC Right for You? What You Need to Know Before Moving Langley, BC has become one of the most talked-about places to live in the Metro Vancouver area. With its blend of affordability, community charm, and access to outdoor spaces, it's no wonder that more people are making th Living in Campbell Valley & Otter District (Langley BC Neighbourhood Tour)🌲 Living in Campbell Valley & Otter District, South Langley BC: Rural Charm Meets Luxury Living If you’ve been dreaming of spacious acreage, fresh air, and a serene lifestyle just outside the hustle of the Lower Mainland, South Langley might be calling your name. In particular, the Campbell Valle

Living in Campbell Valley & Otter District (Langley BC Neighbourhood Tour)🌲 Living in Campbell Valley & Otter District, South Langley BC: Rural Charm Meets Luxury Living If you’ve been dreaming of spacious acreage, fresh air, and a serene lifestyle just outside the hustle of the Lower Mainland, South Langley might be calling your name. In particular, the Campbell Valle

OTHER BLOGS

- Top 5 Middle Schools in Langley BC Canada Revealed!

- Thinking About Living in Surrey BC? Watch This!

- Why is EVERYONE Leaving Surrey BC?

- 5 Things You NEED to Know About Living in Maple Ridge BC

- Living in Panorama Ridge Surrey BC - EVERYTHING You Need to Know!